Schedule 3 1040 2025. Page last reviewed or updated: On this page, we will post the latest tax information relating 2025 as it is provided by the irs.

Net profit or loss from irs form. Taxpayers may also deduct certain casualty and theft losses on.

This Form Is Also Two Pages And Has Two Parts.

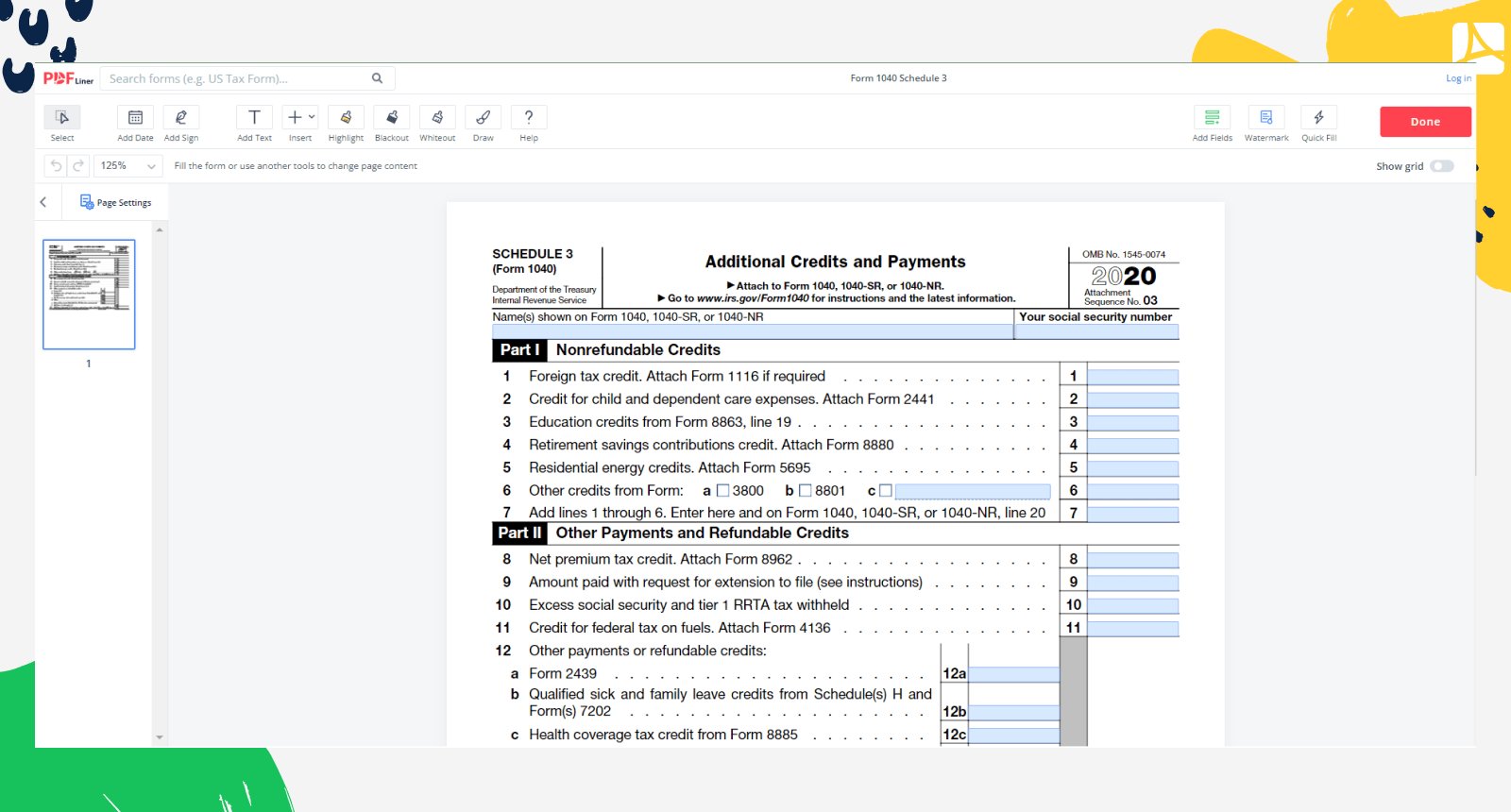

• part i of form 1040 schedule 3 is for nonrefundable credits, including the foreign tax credit, child and dependent care credit, education credits, and more.

Part I Is Titled Nonrefundable Credits.

The $10,000 cap on deducting state and local taxes on schedule a of the 1040:

Tax Rate Schedules Can Help You Estimate The Amount Of Tax.

Images References :

Source: www.dochub.com

Source: www.dochub.com

Schedule 3 Fill out & sign online DocHub, 2025 irs income tax estimator. On this page, we will post the latest tax information relating 2025 as it is provided by the irs.

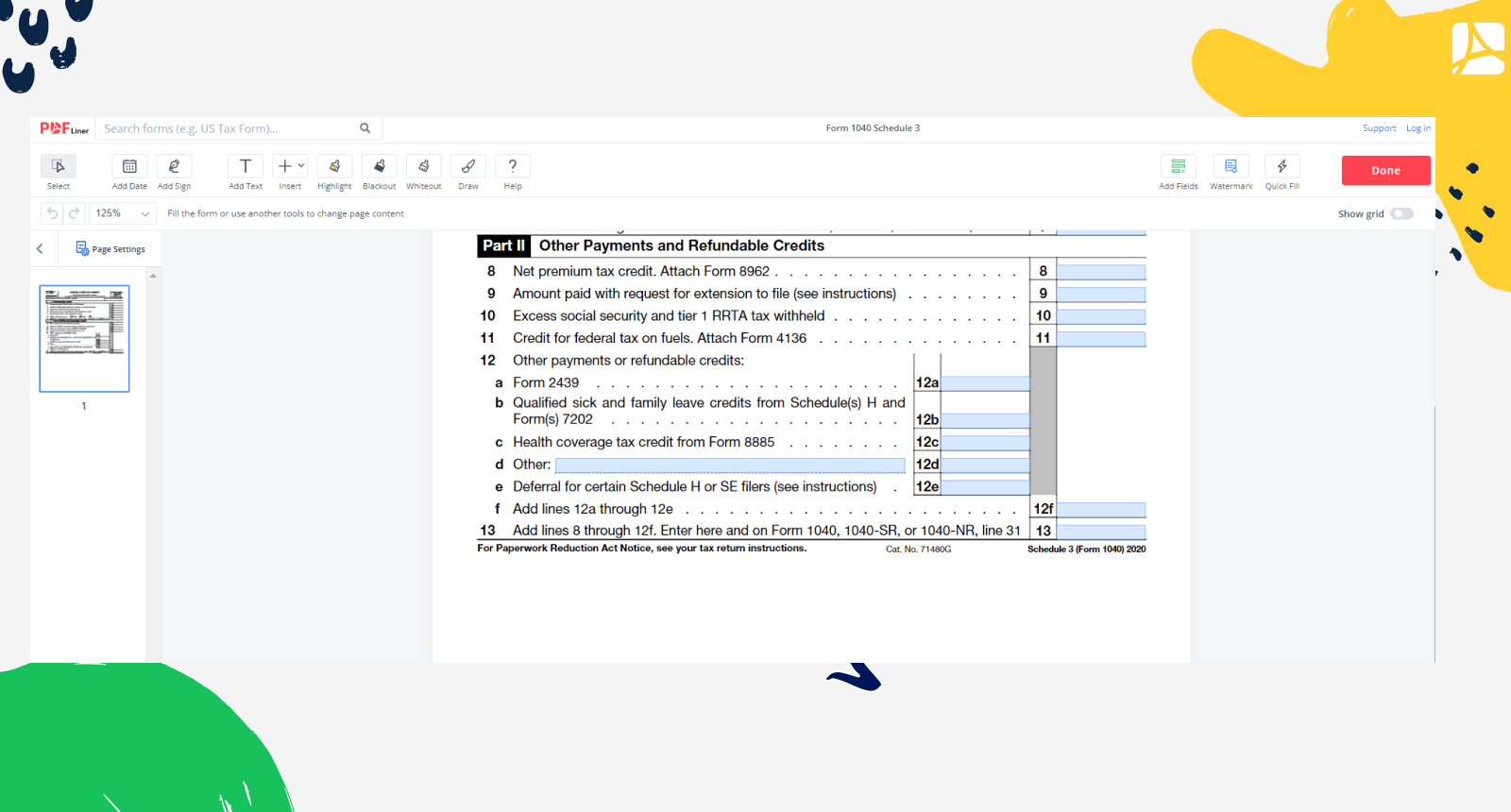

Source: pdfliner.com

Source: pdfliner.com

Form 1040 Schedule 3, fill and sign online PDFliner, Schedule a (form 1040) for itemized deductions. It is also provided that the financial statements shall be prepared in the form provided in new schedule iii of companies act, 2013.

Source: www.studocu.com

Source: www.studocu.com

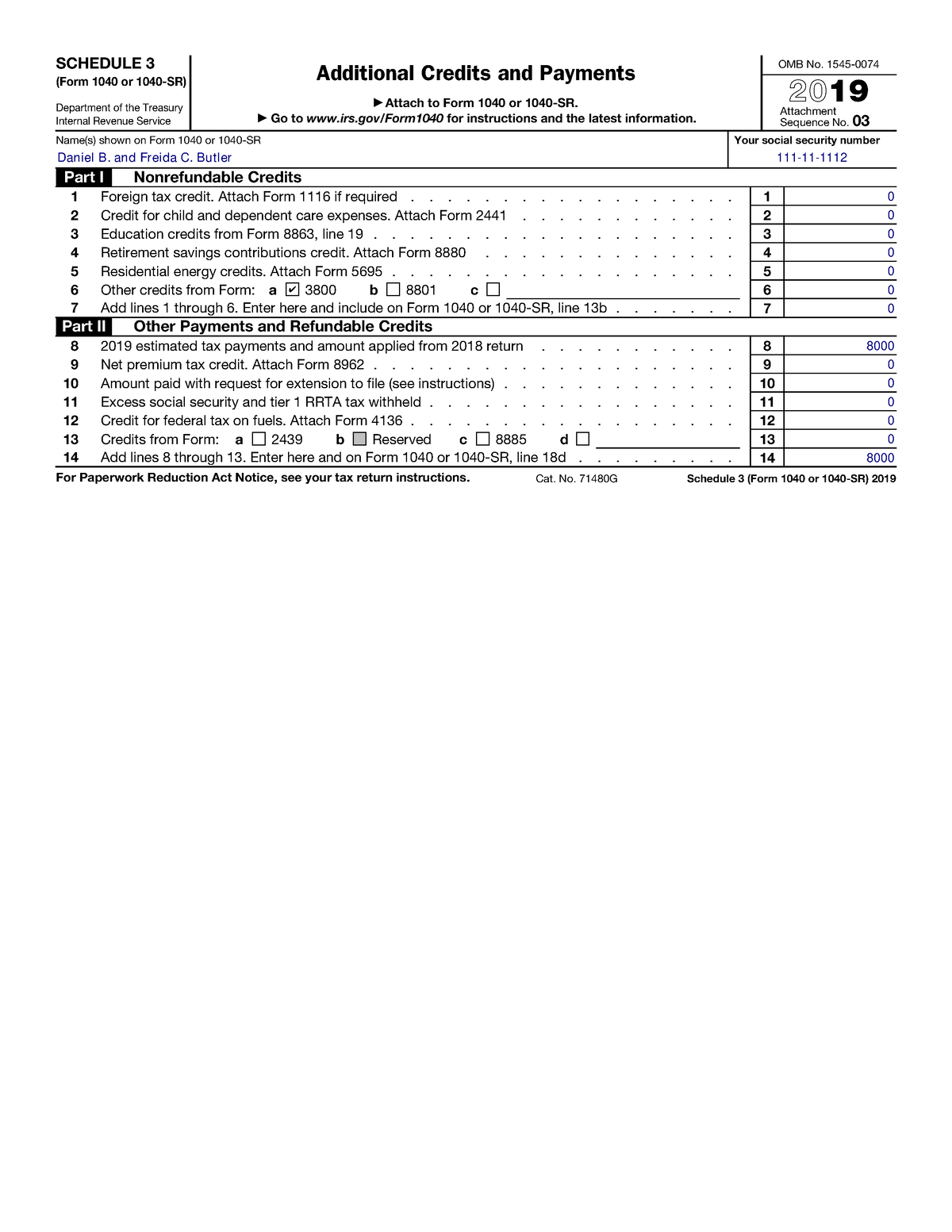

Schedule 3 Department of the Treasury Internal Revenue Service Studocu, Irs form 1040 schedule 3 is supplementary to the main irs form 1040 for tax year 2023. Schedule 3 (form 1040) is an additional form that you may need to complete and attach to your form 1040, depending on your individual tax situation.

Source: pdfliner.com

Source: pdfliner.com

Form 1040 Schedule 3, fill and sign online PDFliner, 2025 irs income tax estimator. It is also provided that the financial statements shall be prepared in the form provided in new schedule iii of companies act, 2013.

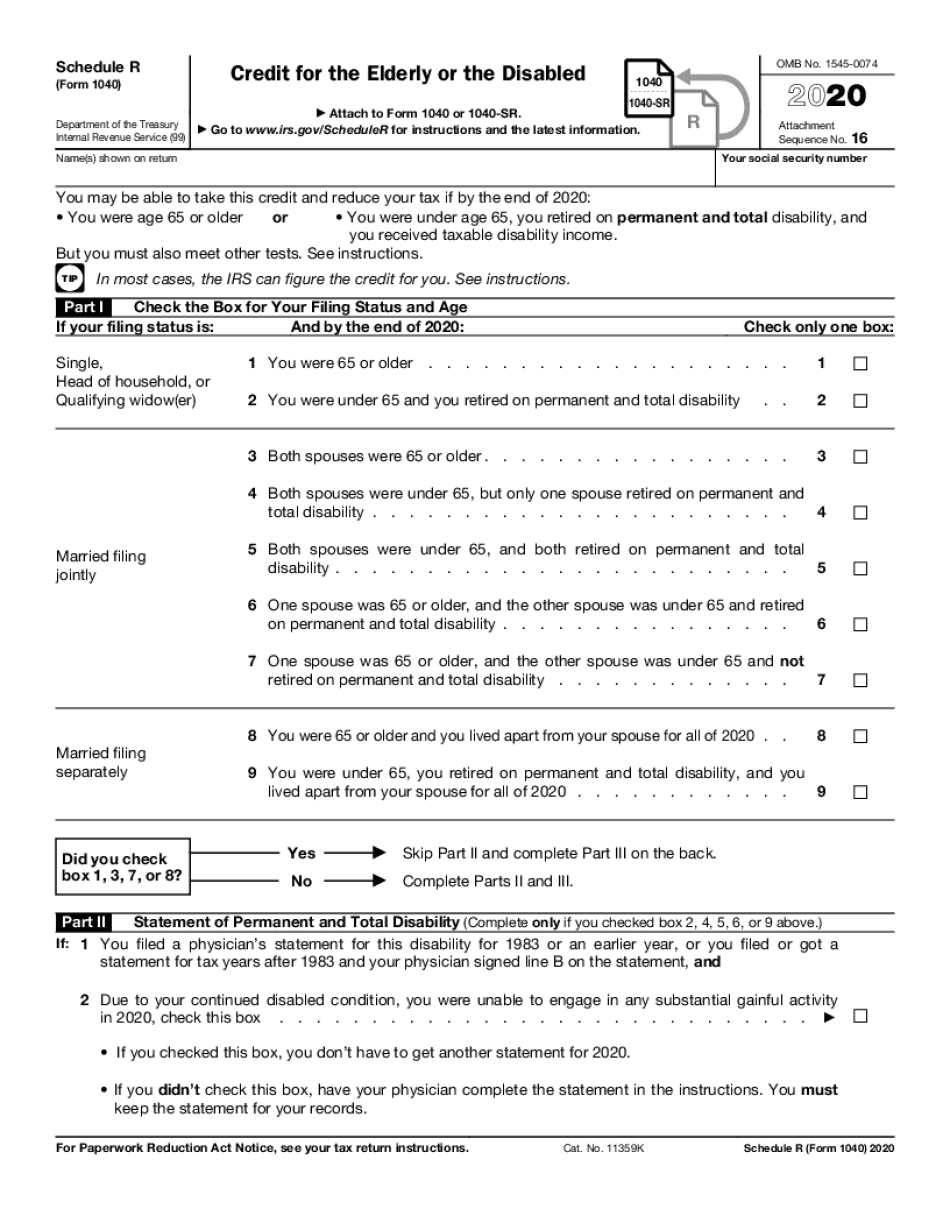

Source: form-1040a-or-1040-schedule-r.com

Source: form-1040a-or-1040-schedule-r.com

irs 1040 schedule 3 Fill Online, Printable, Fillable Blank form, Net profit or loss from irs form. On this page, we will post the latest tax information relating 2025 as it is provided by the irs.

Source: blog.gbsgroup.net

Source: blog.gbsgroup.net

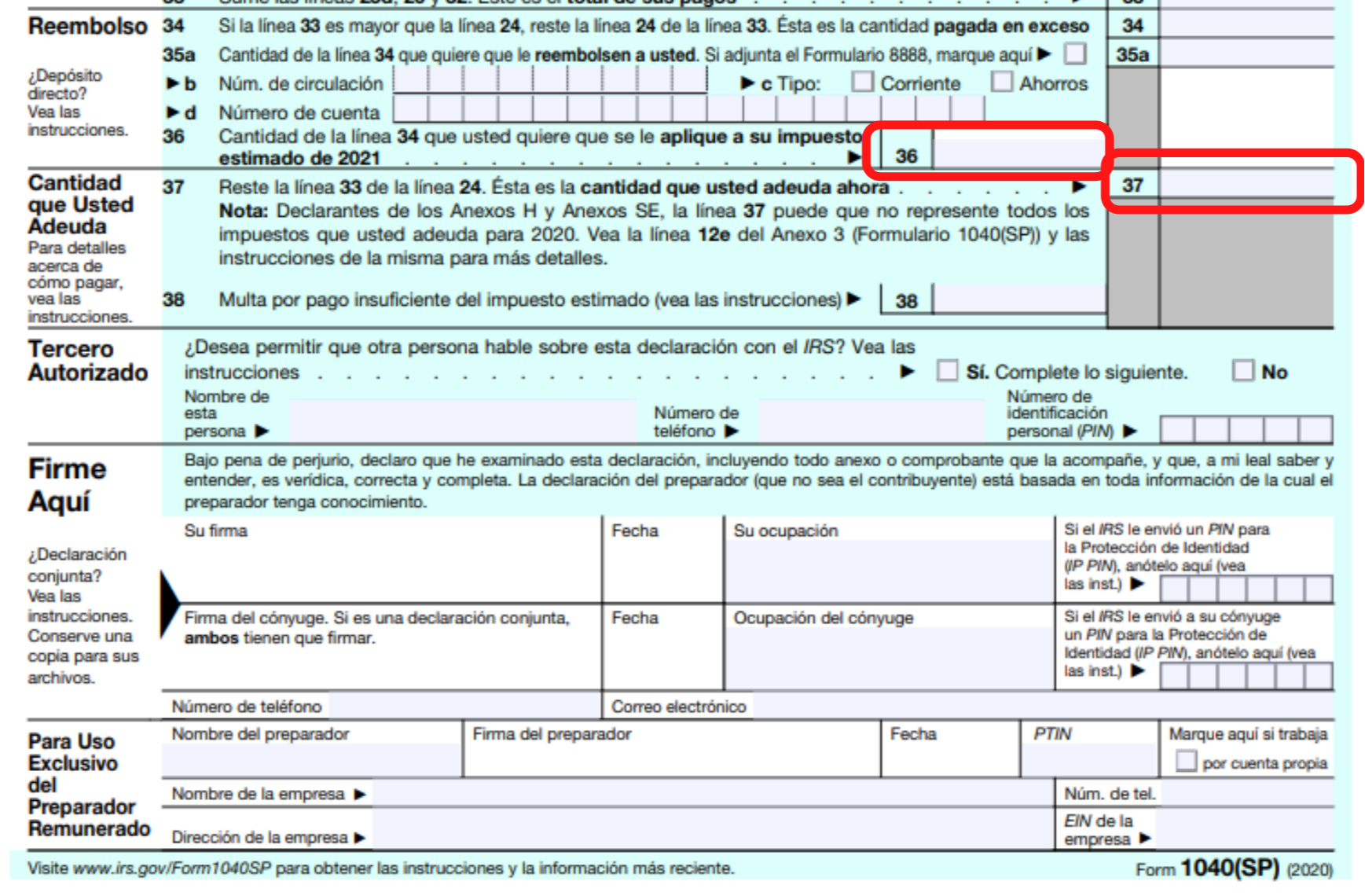

El formulario 1040 y sus variaciones, Irs form 1040 schedule 3 is supplementary to the main irs form 1040 for tax year 2023. The deadline this tax season for filing form 1040, u.s.

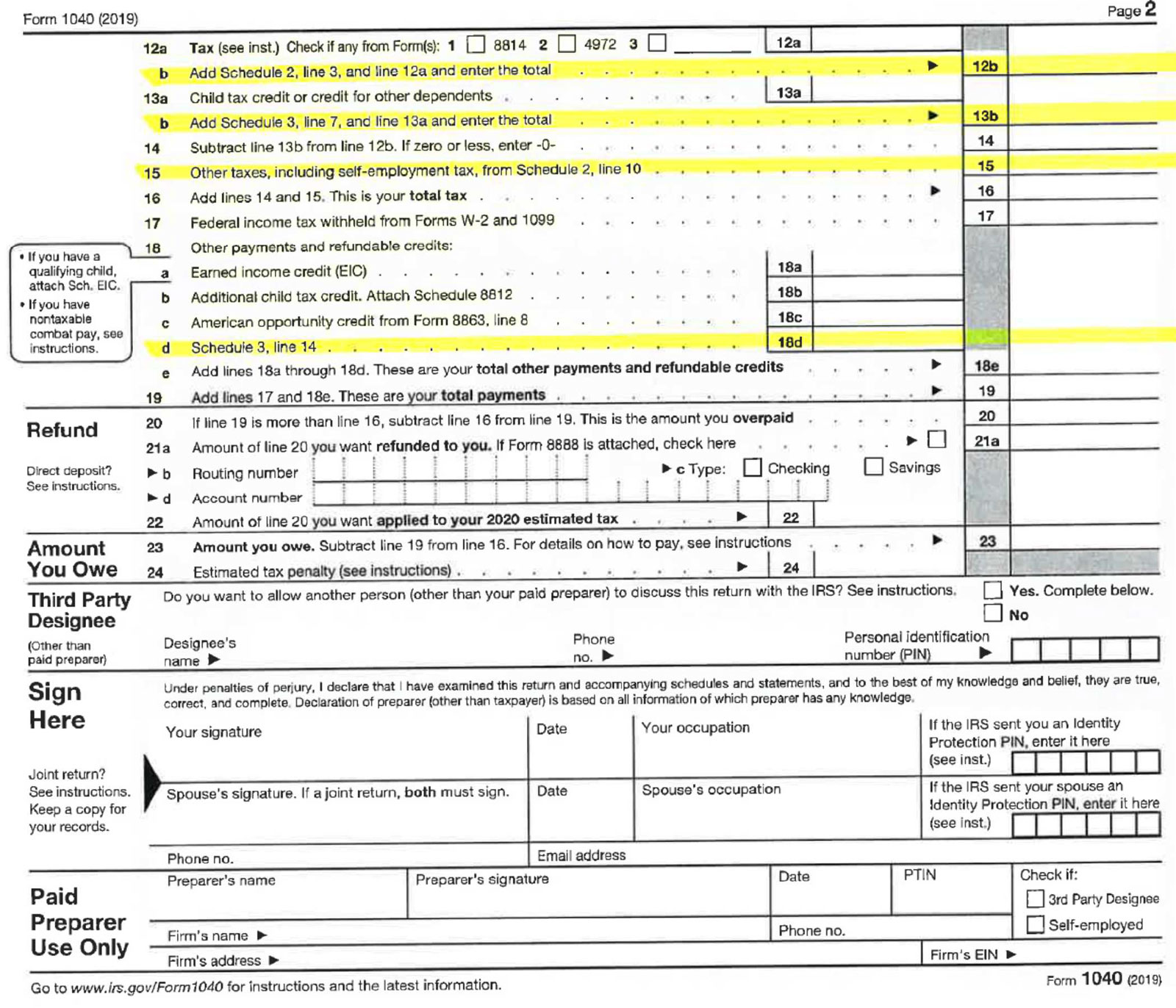

IRS Form 1040 Schedule 3 (2019) Additional Credits and Payments, The deadline this tax season for filing form 1040, u.s. Schedule a (form 1040) for itemized deductions.

Source: ttlc.intuit.com

Source: ttlc.intuit.com

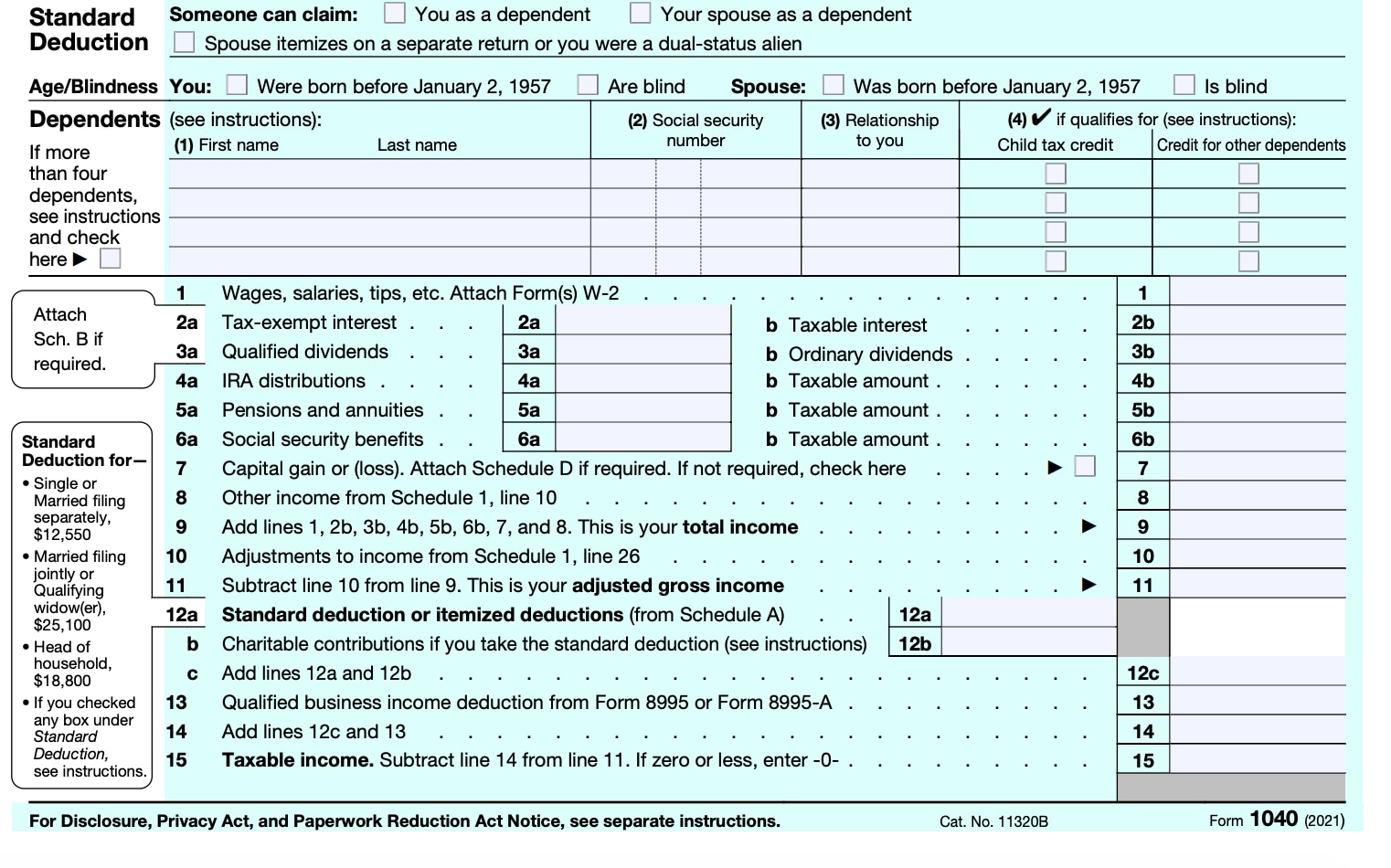

How to understand Form 1040, It may be noted that in the. Schedule 3 is titled additional credits and payments.

Source: www.fity.club

Source: www.fity.club

Instructions For 1040, Sign up now to obtain new tax. • part i of form 1040 schedule 3 is for nonrefundable credits, including the foreign tax credit, child and dependent care credit, education credits, and more.

Source: www.greenbacktaxservices.com

Source: www.greenbacktaxservices.com

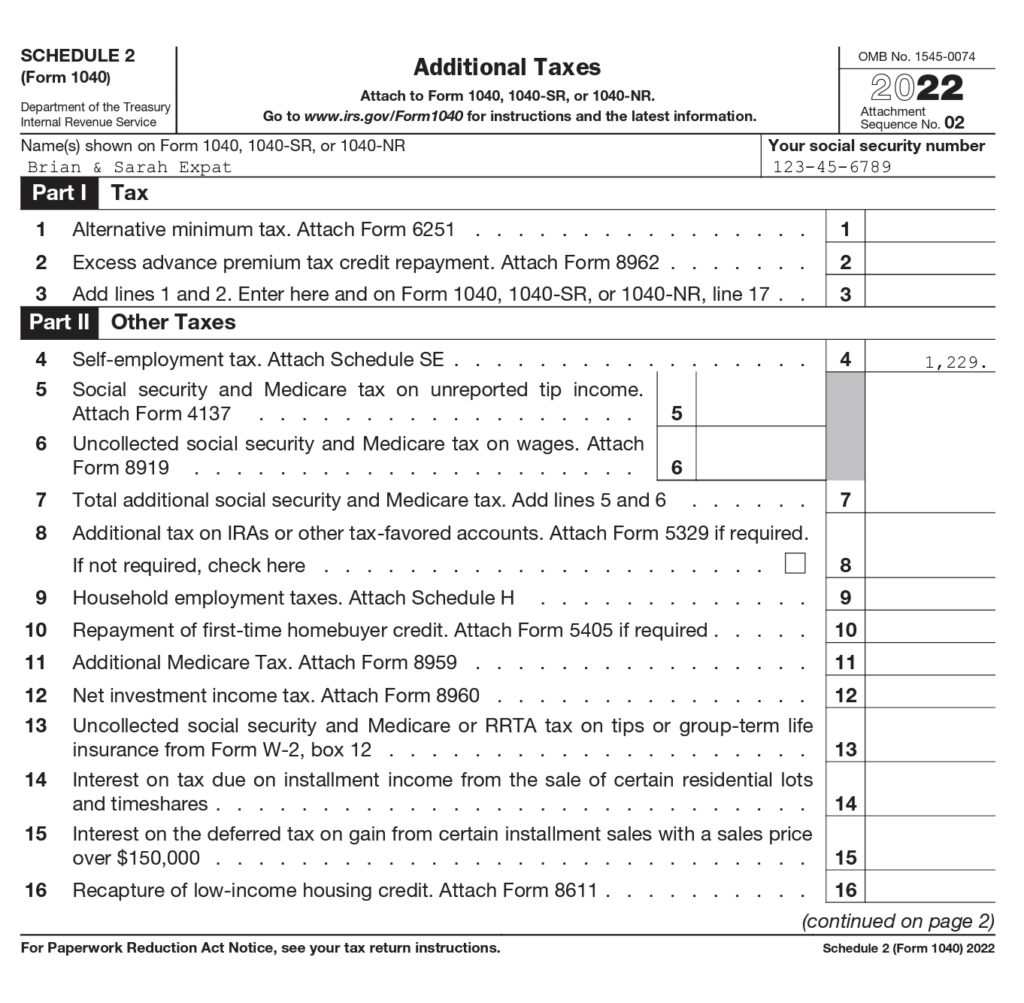

IRS Form 1040 How to File Your Expat Tax Return, This tax return and refund estimator is for tax year 2025 and currently based on 2023/2024 tax year tax tables. Use our free 2025 tax refund calculator to estimate your 2025 taxes (currently based on data available, the tool will be updated as the official tax year data has been released).

This Form Is Also Two Pages And Has Two Parts.

• part i of form 1040 schedule 3 is for nonrefundable credits, including the foreign tax credit, child and dependent care credit, education credits, and more.

Schedule 3 (Form 1040) Is An Additional Form That You May Need To Complete And Attach To Your Form 1040, Depending On Your Individual Tax Situation.

Use our free 2025 tax refund calculator to estimate your 2025 taxes (currently based on data available, the tool will be updated as the official tax year data has been released).