Fsa Mileage Reimbursement 2024

Some employers offer a flexible spending account (fsa), enabling employees to contribute to a personal. Some common eligible travel expenses include:

Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred. Among the limits announced this week are those applicable to health flexible spending arrangements (health fsas) with plan years beginning at any time.

You Can Use Your Fsa Or Hsa To Pay For Qualified Travel Costs Associated With A Dependent's Care.

Some common eligible travel expenses include:

An Employee Who Chooses To Participate In An Fsa Can Contribute Up To $3,200 Through Payroll Deductions During The 2024 Plan Year.

Some employers offer a flexible spending account (fsa), enabling employees to contribute to a personal.

Images References :

Source: cariottawgipsy.pages.dev

Source: cariottawgipsy.pages.dev

Mileage Reimbursment 2024 Minna Sydelle, The standard mileage rate for use of an automobile to obtain health care during the following time periods is as follows: Mileage for travel for medical care is eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), or a health reimbursement arrangement.

Source: juliannawrheba.pages.dev

Source: juliannawrheba.pages.dev

2024 Federal Mileage Reimbursement Xylia Katerina, Some employers offer a flexible spending account (fsa), enabling employees to contribute to a personal. Mileage to and from a medical service is generally an eligible expense under a healthcare flexible spending account, health reimbursement arrangement, or health savings.

Source: dierdrewclari.pages.dev

Source: dierdrewclari.pages.dev

What Is The 2024 Mileage Reimbursement Rate Janey Lisbeth, For 2024, the reimbursement amount for medical mileage is $0.21 per mile. Among the limits announced this week are those applicable to health flexible spending arrangements (health fsas) with plan years beginning at any time.

Source: www.pdffiller.com

Source: www.pdffiller.com

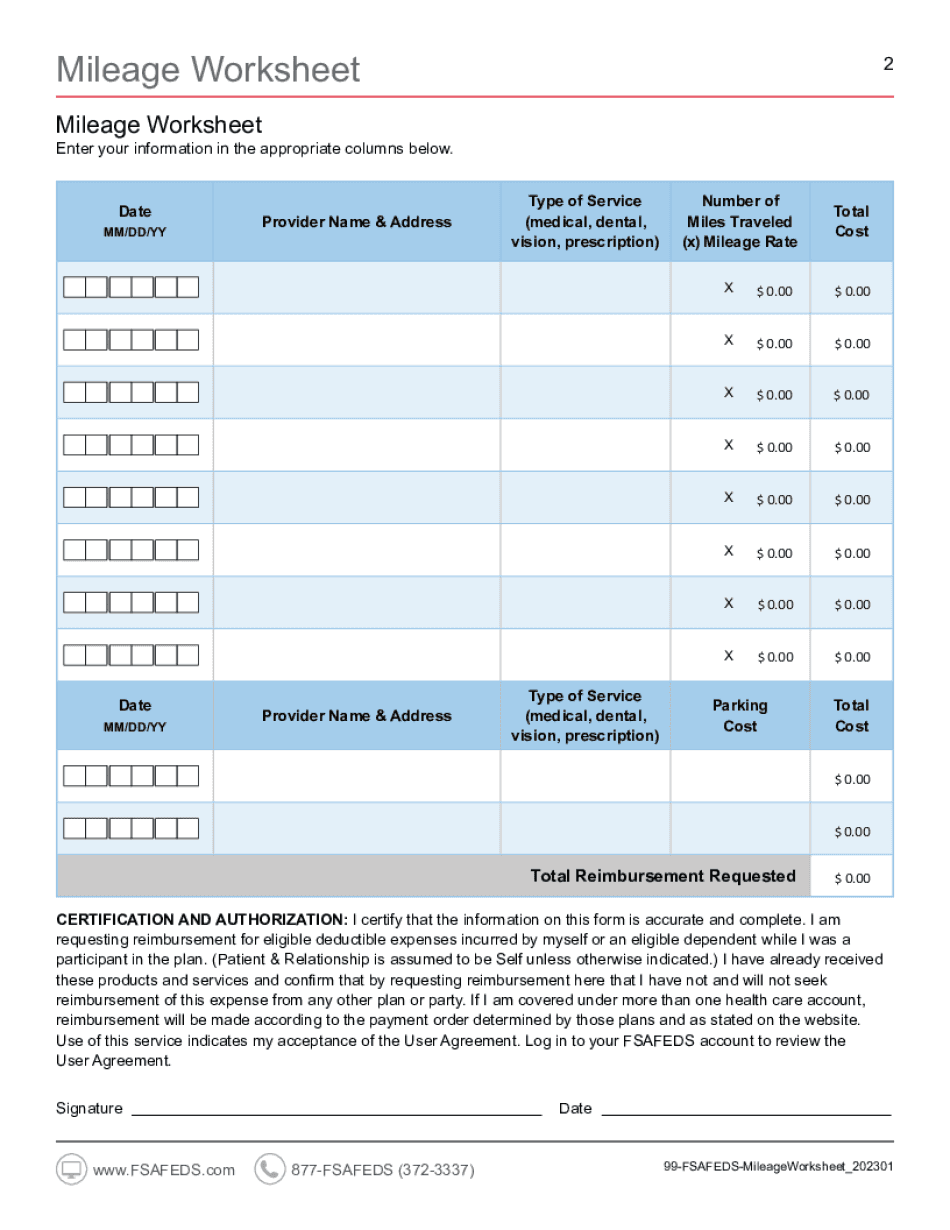

Fillable Online FSA Mileage Reimbursement Request Form Fax Email Print, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2024 plan year. On november 10, via rev.

Source: gusellawbride.pages.dev

Source: gusellawbride.pages.dev

Florida Mileage Reimbursement Rate 2024 Shawn Dolorita, Mileage for travel for medical care is eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), or a health reimbursement arrangement. Some common eligible travel expenses include:

Source: emmiqtandie.pages.dev

Source: emmiqtandie.pages.dev

Mileage Reimbursement 2024 Electric Vehicle Eleen Laverne, The standard mileage rate for use of an automobile to obtain health care during the following time periods is as follows: Increased standard mileage and fsa rates for 2024.

Source: janeqtressa.pages.dev

Source: janeqtressa.pages.dev

State Of Florida Mileage Reimbursement Rate 2024 Marla Karlie, Eligible expenses for use of those funds must have been incurred jan. Mileage for travel for medical care is eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), or a health reimbursement arrangement.

Source: www.signnow.com

Source: www.signnow.com

Mileage Worksheet 20232024 Form Fill Out and Sign Printable PDF, For 2024, the reimbursement amount for medical mileage is $0.21 per mile. Some employers offer a flexible spending account (fsa), enabling employees to contribute to a personal.

Source: teresitawmeade.pages.dev

Source: teresitawmeade.pages.dev

Auto Reimbursement 2024 Erika Jacinta, The irs released 2024 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure. You can use your fsa or hsa to pay for qualified travel costs associated with a dependent's care.

Source: elitaqbernete.pages.dev

Source: elitaqbernete.pages.dev

Mileage Reimbursement Rate For Business 2024 Tilly Ginnifer, Some common eligible travel expenses include: 1, 2023, through march 15, 2024, and deadline to file claims for reimbursement for those.

For 2024, The Reimbursement Amount For Medical Mileage Is $0.21 Per Mile.

1, 2023, through march 15, 2024, and deadline to file claims for reimbursement for those.

The Irs Medical Mileage Rate For 2024 Is Important When Determining Tax Deductions For Your Medical Travel Expenses, As It Allows You To.

Eligible expenses for use of those funds must have been incurred jan.